This is the second part of a three-part series on how conversational AI and automation are transforming the Medicare Advantage experience. To read the first part, Driving Higher Medicare Advantage Conversion with Conversational AI and Automation, click here.

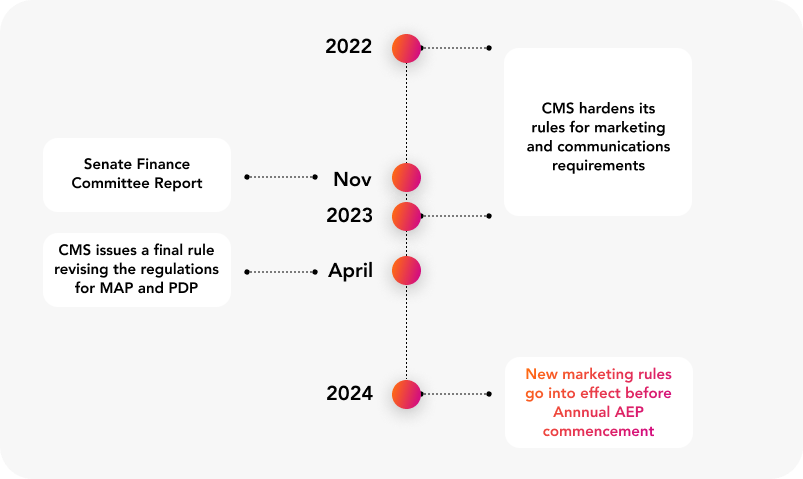

Medicare Advantage marketing has recently come under increased scrutiny by the Centers for Medicare & Medicaid Services (CMS) and lawmakers. CMS hardened its rules for marketing and communications requirements for Part C and Part D programs in 2022 and expanded it in 2023. In this second part of our three-part series, we will discuss how conversational AI and automation can help organizations to stay compliant with these rules and prevent complaints against insurers and TPMOs to CMS.

CMS reported in 2022 that Medicare beneficiary complaints about Medicare Advantage (MA) marketing more than doubled from 2020 to 2021. In November 2022, a Senate Finance Committee inquiry reported that beneficiaries were inundated with aggressive marketing tactics as well as false and misleading information. Consequently, CMS issued a final rule revising the regulations governing Medicare Advantage Plans (MAP) and Medicare Part D Plans (PDP) on April 5, 2023. The final rule strengthened accountability for plans to monitor agent and broker activity. It also finalized requirements for plans to disclose accurate information about benefits coverage, including applicable conditions and limitations on benefits coverage.

The new marketing rules will go into effect before the commencement of 2024 Annual Enrollment Period (AEP). The rules include requirements to record calls, to verbally convey the disclaimer within the first 60 seconds of the call; to avoid using superlatives; to explain how enrollment decisions will impact the beneficiary’s current coverage; and, to ask a list of questions covering topics required by CMS before enrolling the beneficiary in a plan. Any violations could result in CMS enforcement actions and, potentially, monetary penalties.

As insurers and TPMOs build their compliance programs to implement these new requirements into their operations and ensure adherence to new rules, they can leverage conversational AI and automation to monitor the agent and broker communications and provide agents with real-time guidance to follow the requirements during various stages of call. Furthermore, by analyzing 100 percent of calls, these organizations can identify any agents that may be non-compliant and provide reinforcement coaching to those agents.

Monitor and guide agents in real-time to maximize compliance

With conversational AI and automation, organizations can monitor their calls in real-time. Conversational AI can monitor the agent channel to track agents’ recital of the required disclaimer and alert agents if the disclaimer is missing. Conversational AI can also extract entities like caller service area, caller needs, etc. from the conversation. Agents are likely to field calls from different service areas. Dynamic scripts automatically surface the number of organizations, number of plans and details about the plans in caller’s service area to ease the burden on agents.

As the conversation moves forward and callers move towards enrollment, conversational AI can identify caller intents and alert the agents to cover the required questions on the CMS Pre-Enrollment Checklist (PECL) and to explain how enrollment decisions will impact the beneficiary’s current coverage. Based on the intents and entities extracted from conversation, dynamic scripts can automatically surface these questions. What’s more, in the event that an agent ignores the alerts and doesn’t comply with the requirements, the program can alert supervisors in real-time, enabling them to provide in-call feedback to the agent to ensure compliance.

Identify patterns and reinforce coaching where needed

At the same time conversational AI and automation can help maximize compliance through real-time monitoring and alerts, it can also surface trends and patterns across the agent pool and identify potential compliance risks through analyzing 100 percent of calls. For example, speech analytics can be used to identify calls where agents have not covered all the required elements of PECL. These inputs can be analyzed to identify the agents that need reinforcement coaching or service areas where there is a pattern of discrepancies across agents. Any identified gaps can be plugged through coaching/training interventions.

As the share of MA increases amongst the eligible Medicare beneficiaries, CMS requirements will strengthen to protect the beneficiaries and to hold health insurance companies to higher standards. Phone interactions are one of the largest channels through which insurers and TPMOs acting on their behalf enroll new beneficiaries. Continued complaints to CMS about providing misleading information are likely to attract enforcement actions with monetary penalties. To stay ahead of this issue, organizations must leverage conversational AI and automation to monitor their agents in real-time, alerting and guiding them to stay compliant with CMS requirements, and analyze 100 percent of calls to identify potential compliance issues and plug gaps through reinforcement coaching.

)